Resources

A Perk Program designed around your employees.

What are employee perks or a stipend?

An employee perk or a stipend is a monetary advance given to an employee

that allows them to pay for various business expenses. Depending on how the program is

structured, it can either be taxable income to the employee or a non-taxable reimbursement.

Perks or stipends that lack an expense report or a receipt are considered taxable income for the

employee. Most perks or stipends offered on Perkfix.com will be taxable to the employee.

The experiment

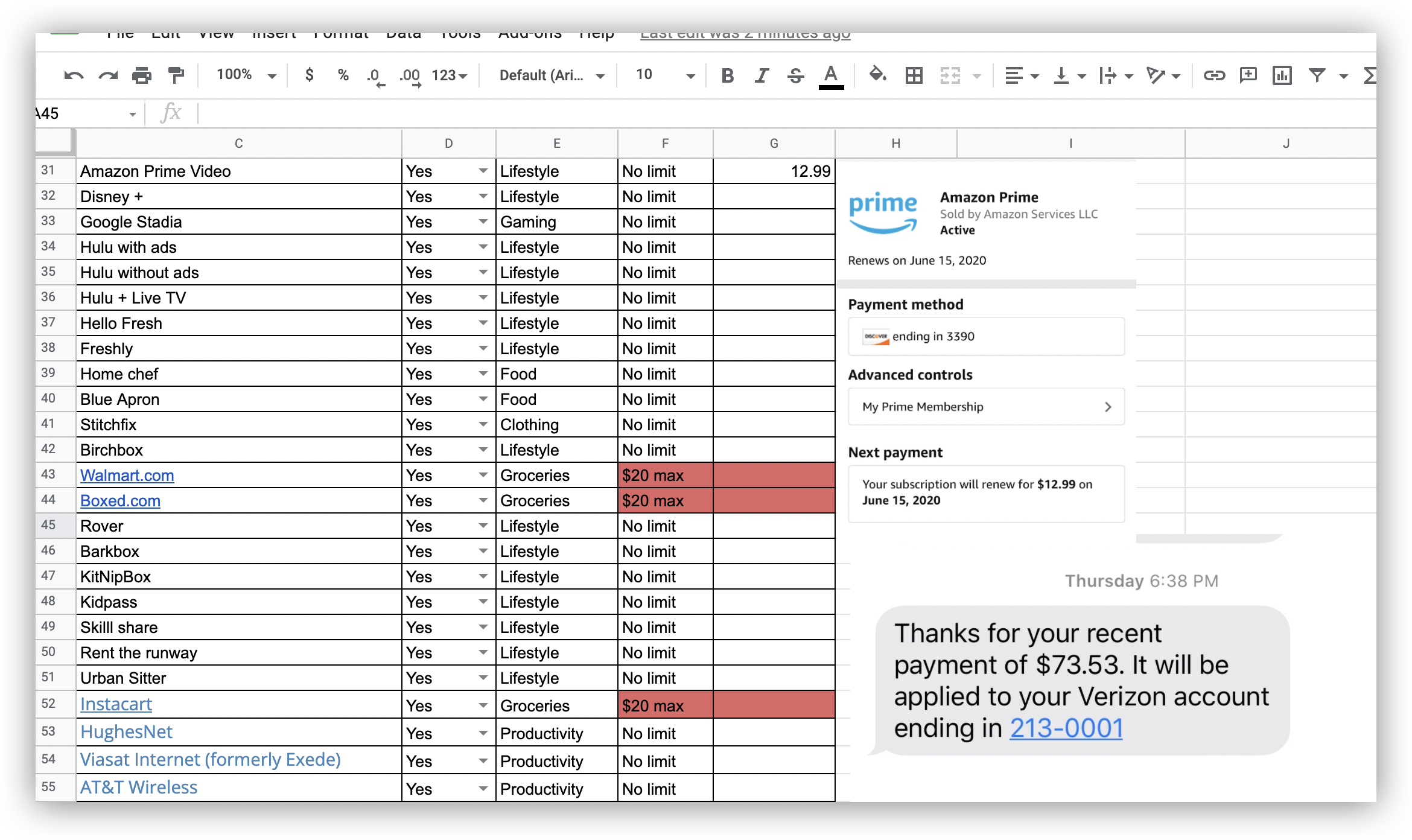

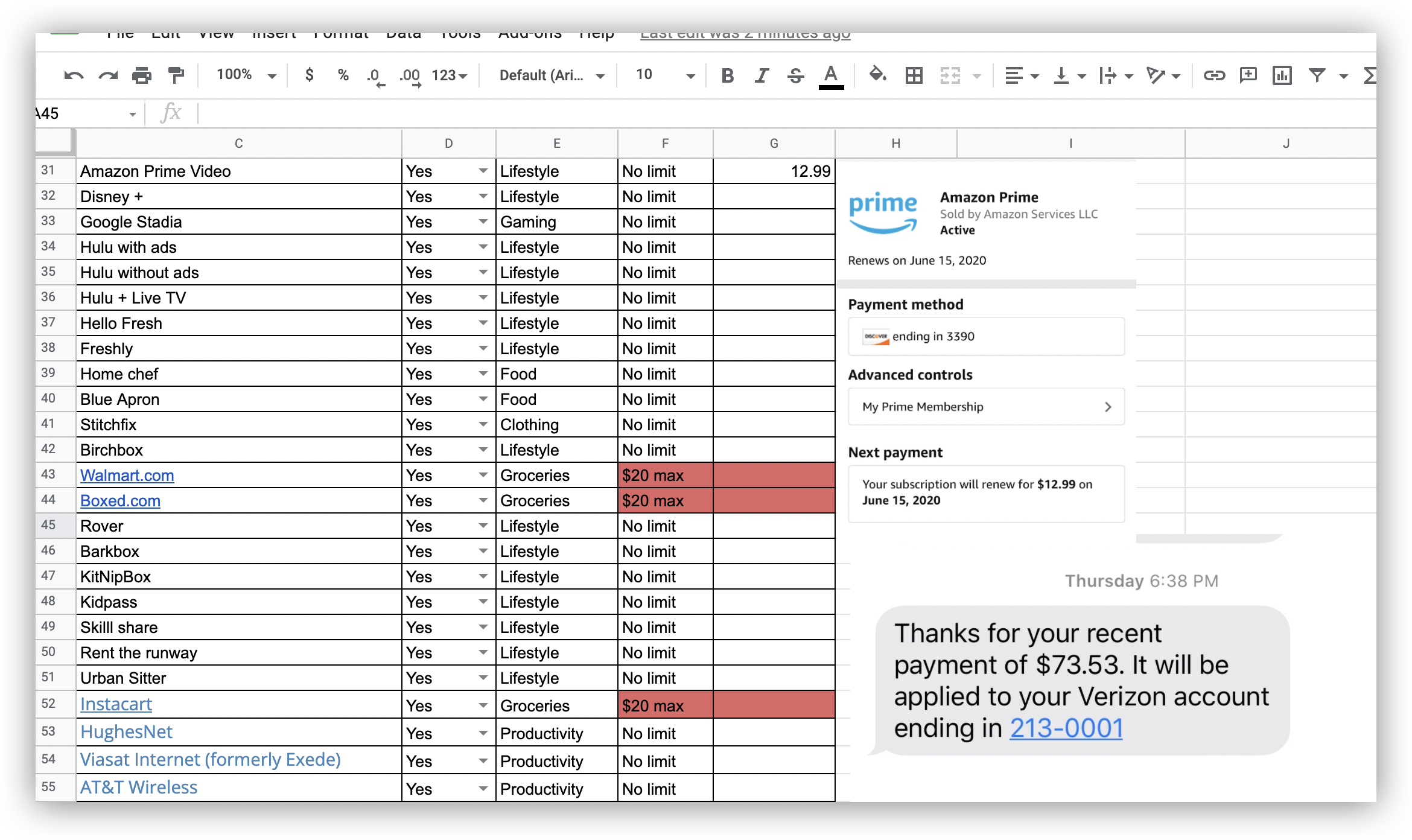

Spreadsheet hell

- •We tried managing a Perk program for five employees in my tech-consulting company using spreadsheets and Google Drive. Soon we were overwhelmed with perk requests, and we were being sent receipts 🧾 via text messages 🤦♂️ . This took a long time ⏰ to administer and became both a clerical & a compliance nightmare 😮.

- •We also realized that employees hate uploading receipts, and they did not always stick to a pre-approved list of perk merchants.

- •It should be of no surprise that I had to shut down 🛑 the entire perk program.

Companies with traditional perks

We researched that many innovative companies give their employees one

particular perk or a stipend, while this is great but we realized that every employee has

different needs, and having a perk program that only caters to a certain demographic does not

help a company in building a diverse team. It also sends a wrong message to employees.

Why the reimbursement model does not work

Some companies have adopted a reimbursement- model to deliver perks.

These "Perk Management providers" merely provide the companies with an excel sheet and a report,

while the actual delivery of the funds are done via employer's existing payroll system. Also,

each transaction needs a receipt which as we have identified hurts employee adoption.

Perkfix admins are able to add pre-approved perk programs and filter out

transactions in real-time. No receipts, no fuss.